To get more information on Denver→ [Denver] & To get more information on Aurora→ [Aurora]

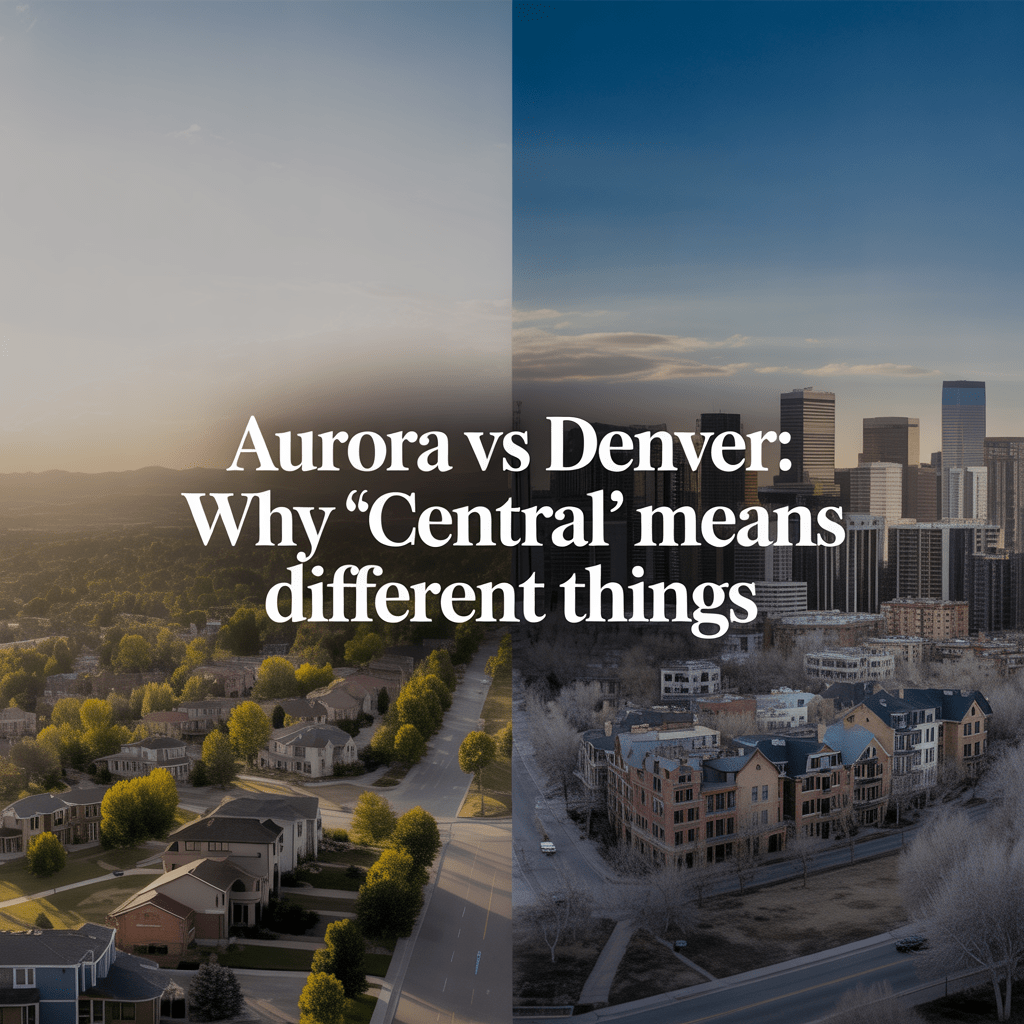

In the Denver metro area, the term “central” carries distinct implications depending on whether it refers to Denver proper or Aurora. For Denver buyers and sellers, central often signals urban density, historic charm, and walkability to core amenities, but at a premium cost tied to limited land and high demand. In Aurora, central areas offer suburban scale, newer builds, and proximity to employment hubs like Buckley Space Force Base and Anschutz Medical Campus, providing more space for families at lower entry points.

This difference shapes buyer behavior, long-term ownership costs, and resale potential in measurable ways. Understanding these nuances helps serious market participants align location choices with practical needs like commute reliability amid Colorado’s variable weather and evolving job centers.

Defining Central Denver

Central Denver encompasses neighborhoods like Capitol Hill, Baker, and parts of Washington Park, where pre-war bungalows and multifamily units dominate the housing stock. These areas prioritize vertical living and infill development due to zoning constraints and urban land scarcity.

Proximity to downtown’s employment, cultural venues, and light rail defines appeal here. Buyers value the 10-15 minute walks to offices or Coors Field, which reduces vehicle dependency and supports premium pricing around $520,000 median sales.

Ownership costs reflect density: higher property taxes from city valuations, plus rising insurance tied to urban risks and older infrastructure maintenance.

Central Aurora’s Distinct Character

Central Aurora, including zip codes like 80013 around Iliff and Peoria, features ranch-style homes and mid-century builds from the 1970s-1990s expansions. This stock emphasizes single-family detached properties on larger lots, averaging more square footage than central Denver equivalents.

Location advantages center on access to E-470, I-225, and RTD lines to Denver’s Union Station in 18-35 minutes by train or bus. Neighborhoods near Cherry Creek State Park draw families seeking buffers from city noise, with medians at $460,000—down from peaks but stable for the segment.

Rising HOA fees and taxes impact budgets similarly to Denver, but lower base prices offset them, yielding better affordability ratios for dual-income households.

Price and Value Comparisons

Aurora’s central homes trade at a 15-25% discount to central Denver medians, with recent data showing Aurora at $519,000 citywide versus Denver metro’s $687,500 benchmark. This gap persists despite both seeing moderated appreciation—Aurora down $50,000 from spring peaks, Denver up 6.8% year-over-year.

| Aspect | Central Denver | Central Aurora |

|---|---|---|

| Median Sale Price | $520,000 | $460,000-$519,000 |

| Price per Sq Ft | $487 | $251 |

| YOY Change | +4.2% | -1.1% to -9% |

| Typical Lot Size | 0.1-0.15 acres | 0.2-0.3 acres |

Lower per-square-foot costs in Aurora reflect abundant suburban inventory, allowing buyers larger homes without sacrificing access. Sellers benefit from faster appreciation in growth pockets, as east Aurora suburbs outpace core Denver’s modest gains.

Commute Patterns and Daily Realities

Commute defines trade-offs: central Denver residents reach jobs in 10-20 minutes via bike or rail, minimizing exposure to I-25 congestion. Aurora’s central buyers face 20-40 minute drives to downtown, but gain shorter paths to airport, tech center, and military jobs—key for 40% of local workforce.

Winter weather amplifies this: snow on Peña Boulevard affects DIA commuters more predictably than urban gridlock, yet RTD reliability favors prepared buyers. Data shows Aurora households average lower vehicle miles due to clustered employers, balancing time against gas costs at $3-4/gallon regionally.

Buyers prioritizing family logistics favor Aurora’s setup, where school runs align with reverse commutes, reducing overall stress compared to Denver’s one-way flows.

Ownership Costs Breakdown

Monthly carrying costs reveal why Aurora appeals to value-focused owners. Central Denver properties carry $3,000+ PITI at 6.5-7% rates, driven by $2,500+ taxes and $200-300 insurance.

Aurora equivalents hit $2,500-2,800, with concessions averaging $8,000 covering buydowns amid softening prices. HOAs add $100-200 in both, but Aurora’s newer roofs and exteriors cut maintenance 20-30% long-term.

These differentials matter for 10-20 year holds, where Aurora’s lower entry preserves equity during rate cycles.

Buyer and Seller Psychology

Denver central attracts urban professionals trading space for vibrancy, with behavior skewed to cash-heavy relocators unfazed by $600k+ thresholds. Turnover stays low as owners lock in lifestyle premiums.

Aurora central buyers—often military, healthcare workers, first responders—prioritize practicality, snapping value post-price dips with fewer bidders. Sellers here succeed by staging for spring peaks, when inventory thins and DIA transfers peak.

Market balance favors Aurora negotiators now, with 4.3 months statewide supply extending DOM to 68 days. Psychology shifts to preparation: Denver demands perfection for quick flips; Aurora rewards patience.

Housing Stock and Future Outlook

Denver’s central stock skews older, 60% pre-1980, limiting expansions amid historic overlays. Aurora’s 1970s-2000s builds support additions, aligning with family growth phases.

New construction favors Aurora suburbs, easing central pressure while Denver infills multifamily. Balanced inventory signals steady 2026, with Aurora poised for 5-7% gains from job anchors.

Strategic Considerations for Buyers and Sellers

Buyers: Weigh Denver’s immediacy against Aurora’s scale—test commutes in winter conditions before committing. Sellers: Price to comps, offer concessions; central Aurora moves faster off-season than Denver.

Long-term, Aurora’s affordability sustains equity building amid ownership escalators like taxes.

In comparing Aurora and Denver, “central” reveals core metro tensions: urban intensity versus suburban utility. Each suits distinct phases—early careers in Denver, family establishment in Aurora—guided by costs, commutes, and stock realities that endure beyond cycles.

Reach out to me for personalized analysis on these markets and how they fit your next move.

The HOA Reality in Denver Suburbs No One Explains Before Closing

To get more information on Denver → [Denver] & Overall Market Info → [Market Insights] In Denver’s suburbs, from Littleton to Arvada, most homes sit within homeowners associations. These groups promise maintained neighborhoods but bind owners to rules and costs that shape daily life and long-term ownership. Buyers often overlook these details until after closing, facing…

Why New Construction in Colorado Isn’t Always the Safer Bet

To get more information on Denver → [Denver] & Overall Market Info → [Market Insights] Buying a new home in Colorado can feel like an easy decision. New construction promises modern design, energy efficiency, and a turnkey lifestyle — qualities that seem to reduce the stress of ownership. Yet in practice, new doesn’t always mean better or safer, especially in a…

Why “Living Close to the Mountains” Rarely Means What Buyers Think in Denver

To get more information on Denver → [Denver] & Overall Market Info → [Market Insights] Many homebuyers moving to Colorado, and even some locals upgrading within the region, begin their search with a simple vision: to live “close to the mountains.” It’s an appealing idea — crisp views, quick trail access, fresh air, and a sense…

Leave a comment